澳洲BUS5IAF Assignment代写,会计和财务概论作业论文代写

来自澳洲代写的顾客授权发布的introduction to accounting and finance,BUS5IAF作业要求片段,为保护顾客隐私,我们不会将BUS5IAF的答案或sample发布在网站,我们曾经写过BUS5IAF及相关的introduction to accounting and finance类型课程的很多作业及考试、如果你也需要代写这个课程的作业请联系客服WX:QQ 7878393 ,ExcellentDue的代写服务覆盖全球华人留学生,可以为澳大利亚的如:悉尼、墨尔本、布里斯班、阿德莱德、珀斯等地的学生提供非常准时精湛的服务,小作业assignment代写、essay代写,享适时优惠,project、paper代写、论文代写支持分期付款,网课代修、exam代考预约时刻爆单中赶紧来撩。

财务报表–如资产负债表和损益表–传达了一个组织过去的交易。鉴于此,请解释这些类型的财务报表如何帮助用户对一个组织的未来做出决策。

我们不可能确切知道未来会发生什么,因为这涉及到某种程度的不确定性。

在这种情况下,我们能做的最好的方法是将未来的决策,至少是部分决策建立在…。

Questions:

Q1.

Financial statements – such as the Balance Sheet and the Profit and Loss Statement – communicate past transactions of an organisation. Given this, explain.how these types of financial statements help users make decisions about the future of an organisation.

- It is impossible to know exactly what will happen in the future because it involves some level of uncertainty.

- The best way that we can do this in this context is to base future decisions, at least partly, on past outcomes and data.

- Therefore, even though information from an organisation’s financial statements may be based on past transactions, this information provides a useful basis upon which we can base decisions and judgments about its future performance.

Q2.

Would you expect the operating profit margin to be higher or lower than the gross profit margin? What is a good operating profit margin? Your answer must be written in your own words.

- Operating profit margin will be lower than the gross profit margin.

- This is because the gross profit margin is calculated before the deduction of operating expenses.

- A good profit margin depends on a number of factors with a key factor being the industry that the business competes in.

- For example, a supermarket often operates on low operating profit margin to stimulate sales and, thereby, increase the total amount of profit generated.

- A jeweller, on the other hand, may have a high operating profit margin but a much lower level of sales volume.

- Factors such as the degree of competition, the type of customer, the economic climate and industry characteristics (such as the level of risk) all influence the ideal operating profit margin of a business.

Q3.

What does Net Present Value (NPV) analysis tell you? Why is it considered the best approach for capital budgeting? Your answer must be written in your own words.

- NPV analysis estimates the impact of an investment opportunity on the value of the firm.

- It quantifies, in dollar ($) terms, the increase in the value of an organisation arising from a particular decision.

- It is considered a particularly powerful tool because it focuses on cash as the driver for value and takes into account factors such as cash inflows and outflows, time value of money, and risk.

- NPV therefore allows you to decide if a decision should (or should not) be pursued based on whether it maximises the value of the firm.

Q4.

What is a firm’s weighted average cost of capital (WACC)? Why is it important? Your answer must be written in your own words.

- Cost of capital refers to a firm’s required rate of return to their providers of finance, such as lenders (debt) and investors (equity).

- A weighted average cost of capital (WACC) incorporates the required rates of return of the firm’s lenders and investors and then accounts for the particular mix (i.e. weighting) of the financing sources that the firm uses.

- It is important to understand because most firms raise capital to fund investments with a combination of debt and equity.

- A firm’s WACC is simply a weighted average of the cost of the sources of capital and as such, plays an important role in determining whether decisions (e.g. investment decisions) will enhance the value of the firm.

Q5.

Tom turned 25 today and plans to start saving for his retirement. He currently has $10,000 to invest. Assuming an interest rate of 10% p.a. compounding annually, how much will Tom have in 40 years? Round your answer to two (2) decimal places.

- FVn= C x (1 + r) n

- FV40= 10,000 (1.10)40

- FV40= $452,592.56

Q6.

What does it mean to say that two or more investment projects are mutually exclusive?

- If two or more projects are mutually exclusive, the firm can only choose one of them.

- This often arises because they use a resource that can only be used for one of the potential projects, such as a piece of land.

- Once the decision is made to accept one of the projects (the best project), the other projects become no longer available.

Q7.

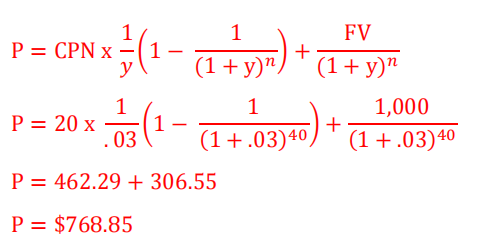

Chalk and Cheese Ltd has recently issued domestic bonds in order to raise capital for the purposes of expanding. The bonds pay quarterly interest of $20. The bonds have 10 years until maturity and have a par value of $1,000. The market rate of interest is 12%. Based on this information, what is the market value of the bonds issued by Chalk and Cheese Ltd?

If you are a student from an English-speaking country, please feel free to contact us at [email protected] and we will provide you with an excellent writing service.

为什么选择ExcellentDue 代写

我们的留学生学术服务经验已超十年、超万人在我们的服务中受益,,我们没有任何学术丑闻,我们保护顾客隐私、多元化辅导、写作、越来越多的小伙伴选择ExcellentDue为他们解决棘手的各类作业难题,保障GPA,为留学梦助力! 知识是可以获得的东西,而思考的习惯和能力却不是那么容易学到的,学习必须和思索交替进行,要学习,即使学习苦得要命, 我们的客服团队及写手老师总是能第一时间响应顾客的各类作业需求,有些人即使有重要的事甚至带伤上场协助考试。Final季,忙的时候一天十几场考试还在继续坚持着,我知道,他们明明可以不用这么辛苦的…但是他们为了坚守承诺,为了另一端屏幕外的那一份期望,他们没有选择退缩、时刻为同学们提供最好的!这么有温度的代写还不添加备用一下?WX/QQ: 7878393